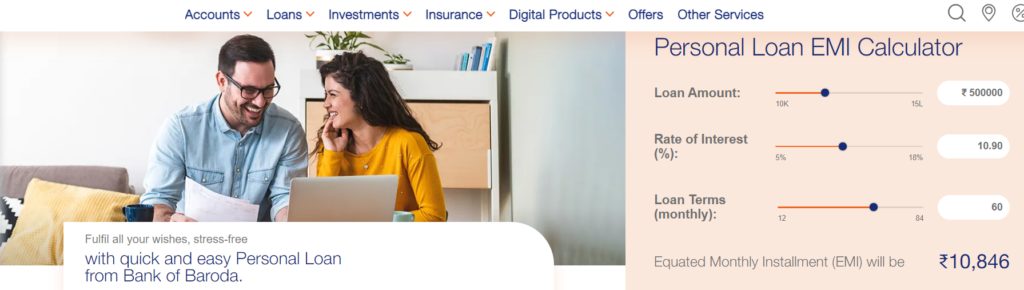

Bank of Baroda Personal: When there are unexpected expenses or you want to fulfill your dreams, a personal loan can provide the necessary financial support. Bank of Baroda (BoB) offers personal loans with competitive interest rates and seamless application process. In this article, we will explore the features of Bank of Baroda Personal Loan, including interest rates, online application process and the convenience of using BOB Personal Loan EMI Calculator. Let’s dig deeper and learn how Bank of Baroda can help you meet your financial goals.

Bank of Baroda Personal Loan: Tailored to Your Needs:

Bank of Baroda understands that everyone’s financial needs are unique. Whether you need money for medical expenses, education, home renovations, or any other personal reason, their personal loan product is designed to meet diverse needs. With flexible loan amounts and repayment options, Bank of Baroda ensures that you get a loan customized to suit your specific needs.

Also Read This: Unlock Financial Opportunities with Aadhaar Card Loans: Easy Online Application for ₹50,000 and PM Loan Yojna.

Bank of Baroda Personal Competitive Interest Rates:

Bank of Baroda offers personal loans at competitive interest rates, which makes it an attractive option for borrowers. Interest rates are determined based on factors such as loan amount, repayment term, and your creditworthiness. By getting a personal loan from Bank of Baroda, you can avail affordable interest rates that help reduce the burden of repayment.

Baroda Personal Loan : Interest rates & charges

Convenient Online Application Process:

Applying for a Personal Loan of Bank of Baroda is hassle-free and convenient due to their online application facility. By visiting the Bank of Baroda website, you can easily visit the Personal Loan section and access the online application form. Fill in the required details, submit the required documents electronically, and track the status of your application online. This user-friendly process saves time and effort, allowing you to apply for a personal loan right from home.

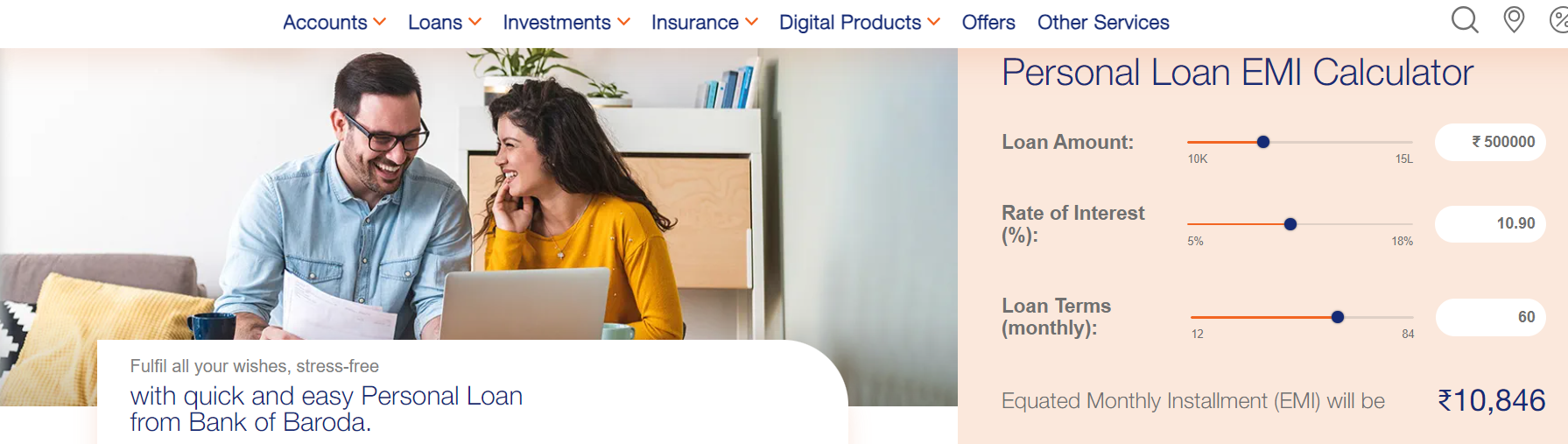

Bank of Baroda Personal Loan EMI Calculator:

To effectively plan your personal loan repayment, Bank of Baroda offers an online EMI (Equated Monthly Installment) calculator. This handy tool allows you to estimate your monthly EMI based on the loan amount, interest rate and repayment period. Using the EMI calculator, you can get information about the affordability of the loan and choose an EMI amount that suits your budget. It helps you manage your finances efficiently and ensures a seamless repayment journey.

Baroda Personal Loan : Eligibility

Eligibility Borrowers

- Employees of central/state Government/autonomous bodies/public/joint sector undertakings, public limited companies/MNCs & educational institutions with minimum continuous service for 1 year.

- Employees of Private limited Companies, Trust, Limited Liability Partnership – with minimum continuous service for 1 year.

- Insurance agents doing business for minimum of last 2 years.

- Self-employed professionals (doctors, engineers, architects, interior designers, tech. and management consultants, practicing company secretaries, etc.) with minimum 1 year stable business.

- Self-employed business persons with minimum 1 year stable business.

- Staff members and NRI/PIO are not eligible

Co-Applicant

Applications to be considered on individual basis only. Co-applicants not to be allowed.

Age

- Minimum: 21 years

- Maximum:

- For salaried persons: Age of borrower plus repayment period should not exceed retirement age or 60 years whichever is lower.

- For non-salaried persons: Age of borrower plus repayment period should not exceed 65 years.

Quantum of Finance

Maximum

- Rs.20.00 lakhs (it is linked with borrower’s occupation and account relationship with Bank)

Minimum

- Rs.1.00 lakh for Metro & Urban Branch Rs.0.50 lakh for Rural & Semi-Urban Branch

Penal interest

Penal interest @2% shall be levied on loan outstanding amount

Processing Charges

For Govt. Employees who maintain salary account with Bank of Baroda: NIL

For others: it ranges from 1.00% of loan amount to 2.00% plus GST, subject to

Mini. Rs.1,000+GST

Max. Rs.10,000+GST

Specific Guidelines for Loan Eligibility

| Employees of Central/State Government / PSUs / Autonomous bodies / listed Public limited with external rating A & above / joint sector undertakings & Educational Institutions with national repute (with minimum continuous service for 1 year and having salary account with our Bank)- | Employees of Central / State Govt. / PSUs / Autonomous Bodies / Joint Sector Undertakings & Educational Institutions with national repute (with minimum continuous service for 1 year and having salary account with other Bank)- | For others | |

| Repayment Capacity (FOIR) | 75% of GMI | 70% of GMI | 40% of GMI to 70% of GMI depending upon the income of the applicant. |

| Repayment Period | 84 Months | 72 Months | 48 to 60 Months |

| Account Relationship | Loan amount up to Rs. 2 lakhs for Employees of Pvt Ltd Co / Public Ltd Co / Trust / LLP, Insurance Agent, Self Employed, Professionals (Doctors / Engineers / Architects etc): Satisfactory account relationship with other bank for at least 6 months.Loan amount above Rs.2.00 lakhs for Employees of Pvt Ltd Co / Public Ltd Co / Trust / LLP, Insurance Agent, Self Employed, Professionals (Doctors / Engineers / Architects etc): Satisfactory account relationship with our Bank for at least 6 months.For Govt Employees: Salary accounts with BOB or other Bank* | ||

Conclusion:

Bank of Baroda Personal Loan provides a reliable and convenient solution for individuals in need of financial assistance. With competitive interest rates, an easy online application process and the support of a Bank of Baroda personal loan EMI calculator, getting a personal loan has never been more accessible. Whether you have immediate financial needs or you want to fulfill your dreams, Bank of Baroda is here to help you with its personal loan offering. Learn about Bank of Baroda Personal Loans today and take a step towards achieving your goals.

What is Bank of Baroda personal loan?

Bank of Baroda personal loan is a financial product offered by the bank to individuals who require funds for personal expenses such as medical bills, education, home renovation, etc. It provides a lump sum amount that can be repaid in installments over a specified period.

What is the interest rate for Bank of Baroda personal loans?

The interest rate for Bank of Baroda personal loans varies based on factors such as the loan amount, repayment tenure, and the borrower’s creditworthiness. The bank offers competitive interest rates to make the loan affordable for borrowers.

How can I apply for a Bank of Baroda personal loan online?

To apply for a Bank of Baroda personal loan online, visit the official Bank of Baroda website and navigate to the personal loan section. Fill in the required details in the online application form and submit the necessary documents electronically. You can track the status of your application online as well.

Can I check the EMI (Equated Monthly Installment) for a Bank of Baroda personal loan?

Yes, Bank of Baroda provides an online EMI calculator for personal loans. By entering the loan amount, interest rate, and repayment tenure, you can calculate the EMI amount. This helps you plan your finances and determine the affordability of the loan.

What documents are required to apply for a Bank of Baroda personal loan?

The documents required for a Bank of Baroda personal loan may include proof of identity, proof of address, income proof, bank statements, and other relevant documents. The specific document requirements may vary based on the borrower’s profile and the loan amount.