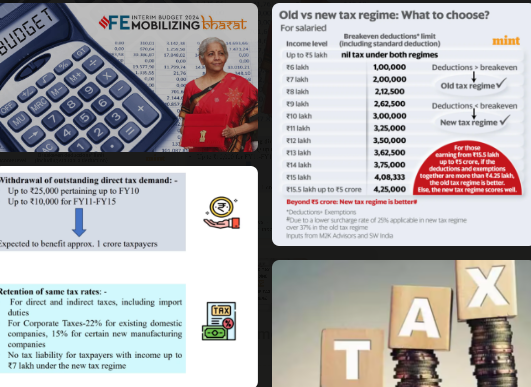

The government’s recent adjustments to the income tax regime have sparked a debate among taxpayers, with the focus on comparing the old and new tax structures. The new tax regime, introduced in the Union Budget 2020, offers reduced tax rates but limits the availability of various exemptions and deductions such as HRA, LTA, 80C, and 80D. On the other hand, the old tax regime provides access to over 70 exemptions and deductions, including popular ones like HRA, LTA, and Section 80C.

Key Amendments in the New Tax Regime

The central government has raised the tax rebate threshold to Rs 7 lakhs from the previous Rs 5 lakhs under the old tax regime. This means that individuals with incomes up to Rs 7 lakhs are now exempt from paying any taxes under the new tax regime. Additionally, the tax slabs have been streamlined to provide a clearer structure for tax calculation.

Revised Tax Slabs in the New Regime

Under the 2023 Budget amendments, the tax exemption limit was increased to Rs 3 lakhs, and the tax slabs were revised as follows:

- Income up to Rs 3,00,000: Nil

- Income from Rs 3,00,001 to Rs 6,00,000: 5%

- Income from Rs 6,00,001 to Rs 9,00,000: 10%

- Income from Rs 9,00,001 to Rs 12,00,000: 15%

- Income from Rs 12,00,001 to Rs 15,00,000: 20%

- Income above Rs 15,00,001: 30%

Overview of the Old Tax Regime

Before the introduction of the new tax regime, the old regime allowed taxpayers to benefit from a wide range of exemptions and deductions, including HRA, LTA, and Section 80C. These deductions effectively reduced taxable income and lowered tax liabilities.

Income Tax Slabs 2023-24 (Old Regime)

- Up to Rs 250,000: Nil

- Rs 250,001 to Rs 500,000: 5%

- Rs 500,001 to Rs 1,000,000: 20%

- Above Rs 1,000,000: 30%

Additional Considerations for the Old Tax Regime

For senior citizens aged above 60 years, the basic exemption limit is Rs 300,000, and for super senior citizens above 80 years, the limit is Rs 500,000.

In conclusion, the decision to choose between the old and new tax regimes depends on individual financial situations and the impact of available exemptions and deductions. Taxpayers are advised to carefully evaluate their options and seek professional advice if needed to make an informed decision.